The Balance tab provides merchants using Match2Pay with a comprehensive overview of their financial status and options for managing funds. With an intuitive design, this section helps you quickly monitor your balance, convert currencies, initiate withdrawals, and track transaction history – all from one place.

Key Features of “Analytics” section:

- Total balance:

- Displays the current balance in the selected currency (e.g., USD) from the dropdown menu.

- Includes a pie chart illustrating the distribution of balances across different currencies (e.g. USD).

- Please note that the difference between the total balance displayed at the top and the values shown in the pie chart may result from currently locked funds (locks), such as pending transactions or temporarily held amounts that are not yet settled or available.

- Balance change:

- Shows a graphical representation of balance changes over a selected time period, highlighting trends and fluctuations in the account balance.

- The data shown on the chart represents End of Day (EOD) balances – that is, the balance at the close of each day during the selected time range. Discrepancies between these historical values and the current total balance may be due currently locked funds (e.g., pending transactions).

- Convert balance:

- Allows conversion of funds between currencies.

- Enter the amount to convert and select the target currency from the dropdown menu.

- Click “Convert” to process the conversion or “Cancel” to discard the action.

- Balance statement:

The Balance Statement feature within the Balance tab allows merchants to generate a downloadable PDF report of their end-of-day balance for every currency used by the client as of the selected date.

- Select a date using the “Choose a date” field (e.g., 25/05/2025) in DD/MM/YYYY format.

- Click the “Generate” button to create and download the balance statement PDF for the selected date.

- Click “Cancel” to discard the action and exit the form.

- Note: This report provides a detailed summary of the balance as of the chosen date

- Crypto deposit:

- Provides a unique QR code and wallet address for topping up the Match2Pay balance.

- Select the desired payment gateway from the dropdown menu.

- Instructions: Send funds to the provided wallet address to add funds to your Match2Pay account. Note that each user will have a unique wallet address for deposits.

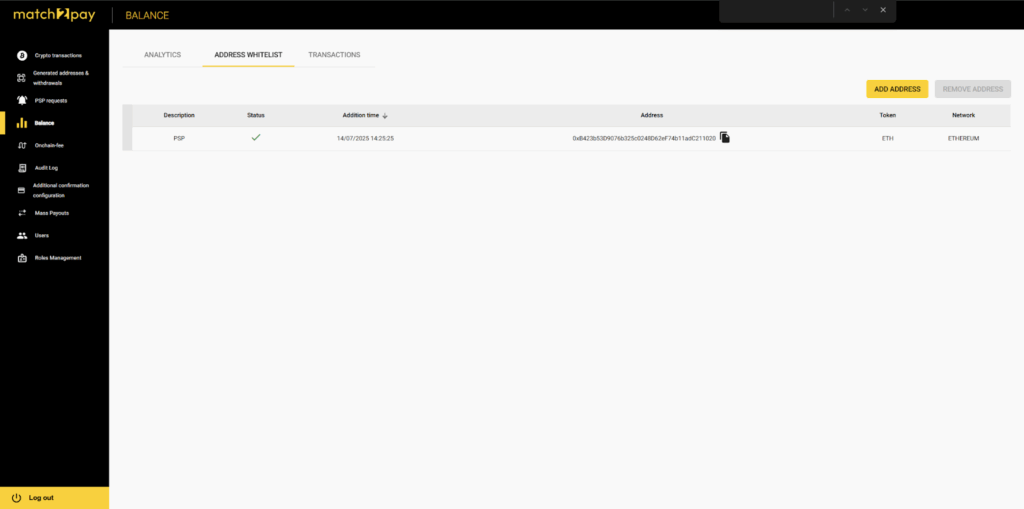

- Crypto withdraw:

- Direct withdrawals require adding a wallet address to the whitelist first. Navigate to the Address Whitelist window under the Balance tab, add the address, and notify the team for approval.

- Once approved, use the “Withdraw Funds” button to initiate a withdrawal. In the Withdraw form, select the wallet address and payment gateway from the dropdown menus, specify the amount to withdraw, then click “Withdraw” to proceed or “Cancel” to discard the action.

- Note: The purpose of direct withdrawals is to transfer funds from your Match2Pay balance to your private or company wallet.

- Transactions

- This section contains a detailed log of operations affecting the balance, such as deposits and withdrawals.

- Select a date range to filter transactions.

- View details including Creation Time, Type, Amount, Transaction ID, Currency, Status, Last Modification Time, and Comments.

- Sort the table by clicking on column headers (e.g., Creation Time in descending order by default).