- Retail Hedge – Introduction

- Retail Hedge rules at liquidity provider

- Short clarification regarding profits on b-book clients

- How to calculate profit on hedge account with open positions

- Where is located Broker’s profit from Hedge Account

- Pentaho reports – checking Broker’s profit on the hedge account

- Broker Profit discrepancies when moving clients with open positions

- How to control discrepancies between clients positions and the hedge account – Hedge Monitor tab in Match-Trader Manager

Retail Hedge – Introduction #

With Match-Trader, there are three ways a broker can operate – It is either playing against his own clients based on a b-book model or sending flow of the clients to the liquidity provider in order to hedge against the risk, which is the a-book model. The third way is to use both models in a hybrid way . Where b-book model could bring more quick profits to the brokerage, it also contains a risk where clients are more profitable than expected, which leads to a broker not being able to meet clients’ withdrawals and finally having to close the brokerage due to bankruptcy. A-book model takes off a such risk from the broker, still alowing him to be profitable from his clients by charging them commissions, markups and swaps. In a hybrid model, brokers can choose to have both a-book and b-book groups, or simply use coverage rules in order to send only a part of the clients’ flow.

For a-book modelled brokerages Match-Trader offer hedge account in Retail Mode – this concept means that each client’s transaction it is mapped by exactly the same transaction on the hedge account. In this case, the hedge account should always have the same number of positions as a-book clients. Even when clients have opposing orders open they will be shown on the hedge account 1:1 as on the client’s account, according to the applied coverage

Important information:

Never close any trades on your hedge account manually, because then your clients will not be able to close their positions!

Retail Hedge rules at liquidity provider #

It’ll be easier to understand this through an example. The Retail Mode is best illustrated in practice using a Match-Trader account connected with a hedge account on liquidity provider.

We assume coverage 100%, which means that if the client opens buy 1 lot of EURUSD in Match-Trader, on hedge it appears with the same volume.

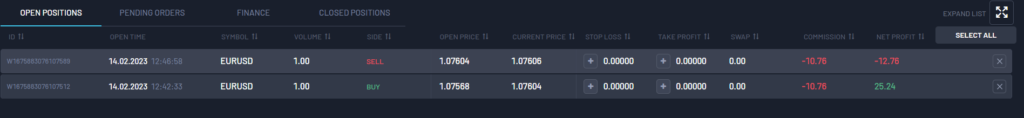

Example 1

A BUY trade of 1 lot on EURUSD was opened:

The same position is opened on liquidity provider hedge account:

Example 2

A trade in the opposite direction was made, a 1 lot of EURUSD on SELL side:

As mentioned at the beginning of the manual, in the case of opening opposite orders, the same orders will be opened on the hedge account.

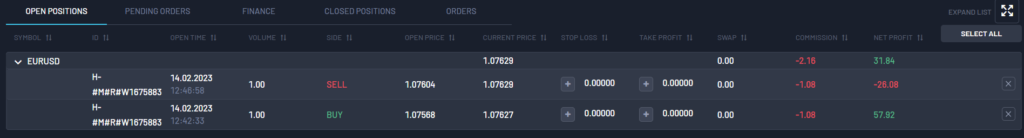

Example 3

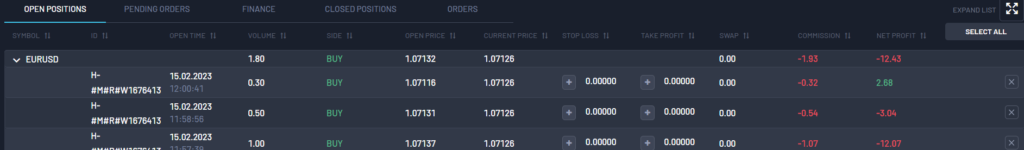

In the next example, we made three trades from a Match-Trader account – all on the same instrument (EURUSD) and side – BUY. Firstly 1 lot at 11:57, secondly 0.5 lot at 11:58, and the last 0.3 at 12:00.

At liquidity provider account we could observe the same situation:

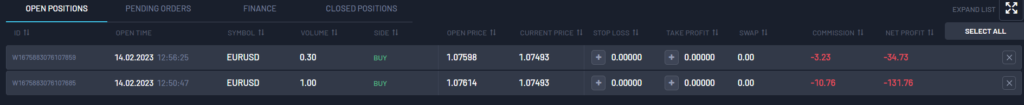

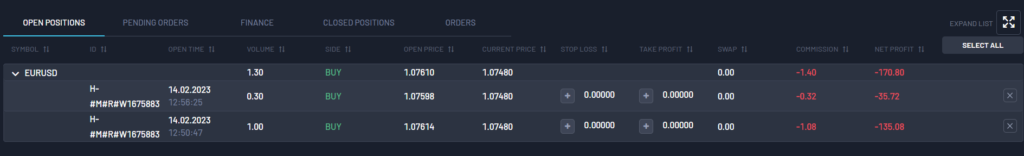

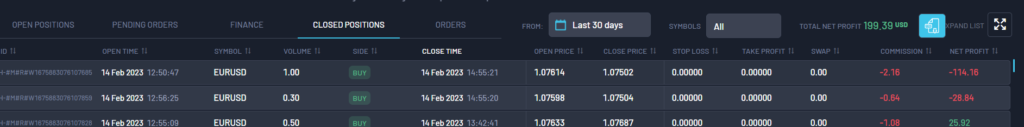

Next, we decided to close only 0.5 lot of EURUSD in a Match-Trader account, the middle trade. Afterward, we have two trades remaining in the Match-Trader account (screen 7 ): 1 lot with loss of almost 132 USD and 0.3 lot with loss of over 34 USD at the price of 1.07493 :

On the liquidity provider account we could observe that exactly the same trade has been closed.

Short clarification regarding profits on b-book clients #

When a client is located in a b-book group it basically means that the risk of clients being profitable is fully on the Broker’s side. It means that all profits of the clients have to be covered by the Broker. While hedging your clients, broker completely mitigate the risk of clients being profitable, not being able to meet withdrawals and possibly being forced to close the brokerage. Utilizing a-book (STP) broker can profit without any risk based on turnover. Clients placing their trades are being charged commissions, markups from spreads, swaps. Having considerably better trading conditions on the hedge account, broker gains the differenc between client accounts and hedge accounts.

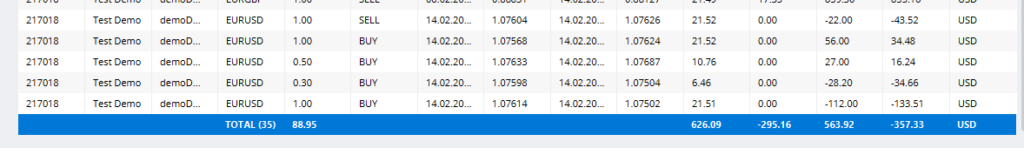

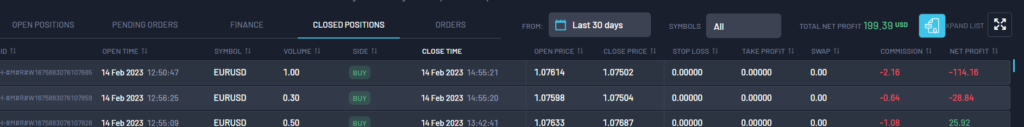

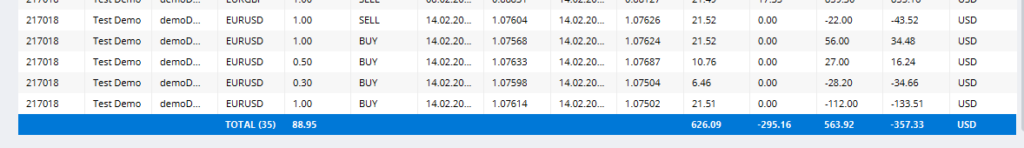

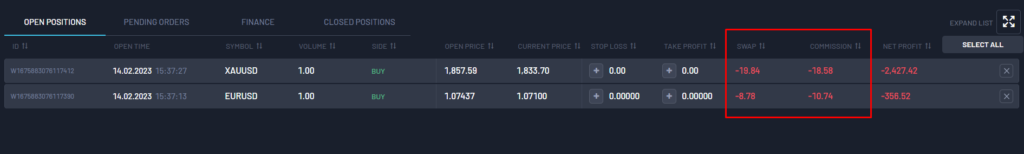

Example : in the screenshot 9 you can see the history of a traders, which belong to the group with a commission with 10$ per 100k and no markups, with net profit of of -357.33 dollars – while on the screenshot 10 you can see the hedge account to which this trader was connected.

However, the result of this trader on the hedge account is positive 199.39 dollars. The difference equaling 556.72 dollars is a risk-free profit for the broker, which was generated solely from commissions. Adding markups for instruments in the group where traders were located, would make the broker even more profitable. Disclaimer – commission and spread markup are charged for the client during the opening of a trade and are not stored anywhere on a separate account – it is simply a difference between the hedge account’s result and the result of a-book clients (more on that in the 5th point).

How to calculate profit on hedge account with open positions #

IMPORTANT – Proper profit calculation in a hedge account is possible if the Broker did not move clients with open positions between a-book and b-book, because these trades will distort the final profit.

IMPORTANT – The result can be also incorrect if the broker moved the clients between a-book and b-book even without open positions. If the broker requests closed trades monthly report from a-book groups at a given time (for example in the end of the month) the report may not include all a-book accounts and trades from this period of time as it will only comprise accounts/trades which are a-book at the moment of report generation.

Profit analysis in a hedge account is fully transparent when the calculation is made for the whole history of the hedge account.

Formula for calculating profit:

Hedge Account – Match-Trader A-book client’s accounts = Broker Profit

(net open profit + closed profit from hedge account) – (net open profit + swaps + commissions on open position + closed profit from Match-Trader a-book)

As it is mentioned above, the components of the result of the hedge account consist of net profit from open position and profit from closed trades. For Match-Trader a-book accounts there is net profit, swaps, commissions from open positions, and profit from closed trades. After we take all of the above into account, the subtraction of the result of the Broker’s retail a-book clients from the result of the hedge account gives the correct Broker profit.

For example:

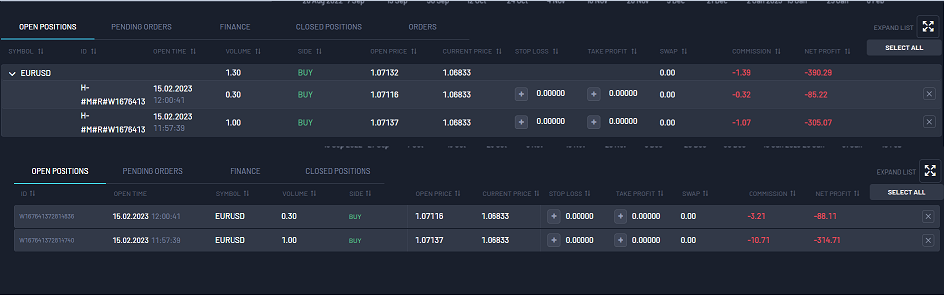

opened positions (hedge account and Match-trader)

Calculation:

Hedge account – Match-Trader account closed and open profit/loss = Broker Profit

(-390,29+199,39) – (-402,82-357,33) = 569,25 USD

(opened positions + closed trade from hedge account) – (opened positions + swaps on opened position + closed trades from Match-Trader a-book accounts)

If a broker wants to calculate profit for a particular month, he needs to know the exact value of the net profit of open and closed trades for the preceding month. In case a broker does not have such information, he can calculate profit from the very beginning of the hedge account’s trading history (assuming that it’s just an a-book Broker or no clients have been moved between a-book and b-book) using the formula from the example mentioned above.

Where is located Broker’s profit from Hedge Account #

The First step to from the a-book model is to set proper markups/commissions on a-book groups so that trading conditions on hedge account are significantly better. It means that investors trading with Match-Trader platform shall receive worse prices/bigger commission for trading. What is already in favor of the broker, is that the default swaps are lower on hedge account than for retail traders.. If all of the above conditions are met, the broker should always profit from the hedge account.

The example presented in the third point was made based on an a-book group with a commission set to 10 usd per lot. On the screenshot, it is clearly visible that hedge account has better trading conditions, so it always comes up with smaller losses/bigger wins. Therefore there is always more money left on the hedge account than on traders’ accounts, which is considered the broker’s profit. Our Pentaho Reports allow brokers to check broker’s profit from each a-book trade separately Explained in point 6).

Pentaho reports – checking Broker’s profit on the hedge account #

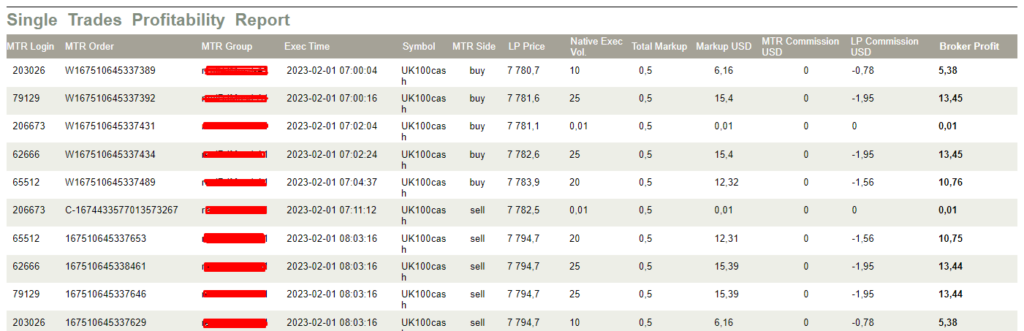

In order to access the page where the Broker can see “Single Trades Profitability Report” from the hedge account and have a look at his profits on a-book, Broker should log in to his Manager, press the “Hedge Monitor” tab, and then again click on “Hedge Reports”, which should redirect to https://reports2.match-trade.com/pentaho/Login. Login credentials are provided by Broker Support along with credentials to other systems. In order to check Broker’s profit, we need to go to the “Single Trades Profitability Report” and check the dates for which the report should be generated. Columns are explained one by one in the sequence as they go.

Column explanation

· MTR Login – Login number of a trading account

· MTR Order – Number of the trade order

· MTR Group – Group where the trading account is located

· Exec Time – Time at which the trade was executed

· Symbol – Symbol traded

· MTR Side – Type of an order, sell or buy

· LP Price – Price at which trade was executed

· Native Exec Vol. – Volume of a trade that was executed

· Total Markup – Markup given in points

· Markup USD – Markup given in USD

· MTR Commission USD – Commission that was paid by the client

· LP Commission USD – Commission that was paid by the Broker to the liquidity provider

· Broker Profit – Summarized profit of the Broker of a single trade

The last column “Broker Profit” is crucial for Broker because it is showing what is the total profitability of a hedged trade. If the value is negative, it means that Broker is paying more fees than he is receiving per trade from his clients. In order to fix this, the broker should increase markups or add commission in his clients’ group. To better calculate the exact value which should be added in markups/commissions, the “Markup Calculator” can be helpful. It can be found in the “Starting Pack” provided by Broker-Support, but if it’s missing, please contact them via Skype or e-mail. The calculator can also be found under the following link: https://docs.match-trade.com/docs/instructions-for-markup-calculator/

Using and analyzing Pentaho Reports is the best and easiest way to monitor and calculate the Broker’s profit. However, it’s important to keep in mind that certain actions as moving clients between a-book and b-book can cause the calculations to be incomplete.

Another report worth mentioning is “A-book simulation report”. This report is used for comparison of the actual Broker’s profit/loss from clients being profitable on b-book and possible gains from those clients if they traded on a-book. It is very useful in spotting potential traders that can multiply their accounts’ balances very quickly and can be used as a guide on which clients should be a-booked.

Broker Profit discrepancies when moving clients with open positions #

There can be a situation when clients are moved from b-book to a-book with open trades but trades on the hedge account will not be opened at the same entry price as the prices on client trades. The entry price on the hedge account will always be a market price at the time when the client is moved to a-book and his positions are hedged. Also, if Broker adjusts positions manually, the price will be the current market price. Because of that, the total profit of clients’ open positions and the total profit of hedge positions will be different as some trades are opened at different price levels. This will also affect pentaho reports – the outcome of a client that was moved from b-book to a-book will not be included in the reports. If trades on the hedge account are opened at the current market price at the time when a client is moved to a-book group (not at the price which is present on his clients’ positions), it will cause the closed trades in the hedge account to be different from a-book clients’ closed trades.

Moreover, this situation also will affect the Match-Trader Manager Closed Trades report. When Broker will generate Closed Trades report for a given month for a-book groups and in that month he had moved clients between b-book amd a-book groups, then the report will not fully reflect real results. This a-book report will include trades which previously were in b-book and which had not been hedged. So these actions (moving accounts between groups) can cause discrepancies in reports between hedge account and a-book clients.

How to control discrepancies between clients positions and the hedge account – Hedge Monitor tab in Match-Trader Manager #

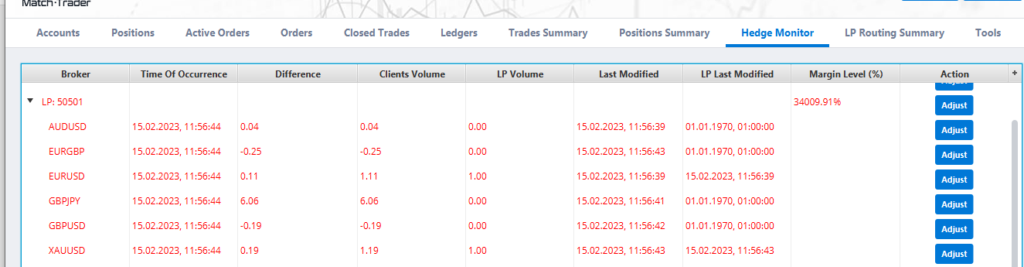

In order to find out if everything is properly hedged, Broker can use the “Hedge Monitor“ tab which is available in the Match-Trader Manager. In this tab, Broker is able to check what volume is opened on the side of his clients and what volume is open on the hedge account.

As was described in previous chapters, there can be a situation where volumes don’t match between these two systems (Hedge Account and A-Book clients’ accounts). This can be caused by Brokers moving clients from a-book to b-book group with open trades or vice versa. Another reason could be a Broker manually opening trades in a hedge account which doesn’t affect the volume from the client’s side. There can also be other reasons (stop-outs on hedge acc, etc), which can cause these discrepancies, so it is very important to monitor this tab on a daily basis.

The hedge monitor will show the exact timewhen a discrepancy happened, the difference between volumes, and after expanding the LP in the “broker”, Broker is able to see the instruments on which the discrepancy occurred. If the reason for a discrepancy is known and Broker wants to adjust it, he can press the button “adjust” which will be visible when the discrepancy takes place. After pressing it, all the discrepancies will be corrected by executing adequate trades on the hedge account.

If such a discrepancy is visible in the hedge monitor and the broker doesn’t know exactly why it happened, Broker-Support should be contacted to investigate it.

In order to control discrepancies, Broker should do a daily check of the hedge monitor. If there is any discrepancy the broker can adjust the position by clicking the Adjust button in the hedge monitor tab.