- FIFO and Netting – General information

- FIFO and Netting rule at liquidity provider

- Retail Hedge – General information

- Retail Hedge rules at liquidity provider

- Short clarification regarding profits on B-Book clients

- How to calculate profit on hedge account with open positions

- Why checking both closed trades and open position profit is crucial to accurately analyse profitability

- Where is Broker’s profit from Hedge Account located

- Pentaho reports – checking Broker’s profit on the hedge account

- Broker Profit discrepancies when moving clients with open positions

- How to control discrepancies between clients positions and hedge account – Hedge Monitor tab in the Bridge Manager

FIFO and Netting – General information #

At FX-EDGE all hedge accounts use netting and FIFO mechanism to book trades, which is a common practice in the FX institutional market. In the following article, we’ve presented the most important information on hedging.

Order netting on an account means that all buy and sell orders are constantly netted (close each other), which means that brokers always have only one net open position for each instrument. Subsequent orders result in increase or decrease in the volume of the existing positions. Opposite orders reducing net exposure of open positions create closing deals that offset open position deals using the FIFO closing rule. FIFO rule means that the oldest deals are closed first (First-in First-Out).

Netting and FIFO don’t impact the results on the hedge account, it’s just another way of booking trades that are visible on the hedge account. Once all trades are closed, the broker will see the same profit on the hedge account as on the client’s account.

FIFO and Netting rule at liquidity provider #

The FIFO rule is easier to explain when illustrated on an example using an MT4 account connected with a hedge account on liquidity provider.

We assume coverage value of 100%, which means that if a client opens buy 1 lot of EURUSD in MT4, on the hedge account it appears on 1:1 value. 1 lot of currency in MT4 equals 100 000 units in liquidity provider.

Example 1 #

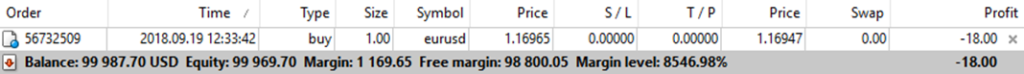

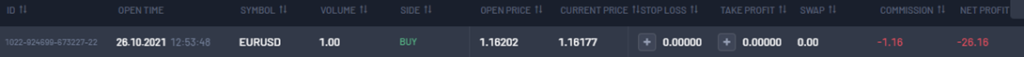

A BUY trade of 1 lot on EURUSD was opened:

The same position is opened on liquidity provider hedge account:

Example 2 #

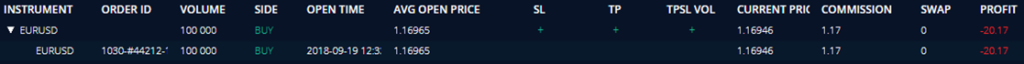

A trade in the opposite direction was made, a 1 lot of EURUSD on SELL side:

Opening of the sell trade on EURUSD caused the closure of the buy trade on EURUSD. On the hedge account, total exposure is the total result of the exposure on trading accounts. This operation is called netting.

Example 3 #

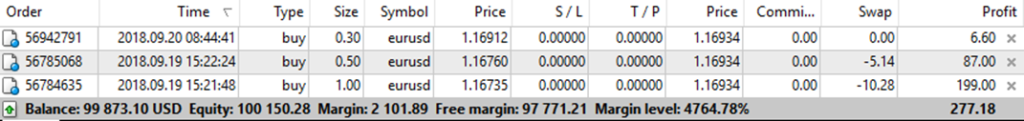

In the next example, we made three trades from an MT4 account – all on the same instrument (EURUSD) and side (BUY). First position for 1 lot at 15:21, second 0.5 lot at 15:22, and the last 0.3 lot at 08:44 on the next day. The total value of open positions is over 277 USD profit at the price 1.16934:

On the liquidity provider account we could observe the same situation:

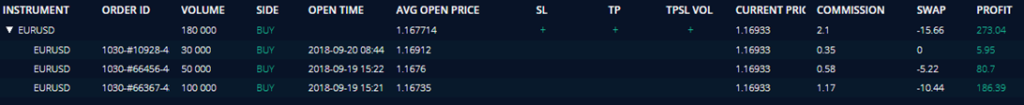

Next, we decided to only close the last trade in the MT4 account – 0.3 lot of EURUSD with a profit 6.6 USD (seen on screen 5). So after this action in the MT4 account, we see two trades (screen 7): 1 lot with a profit of 174 USD and 0.5 lot with a profit of over 74 USD at the price of 1.16909:

On the liquidity provider account, we could observe that due to netting rules, the last trade (0.3 lot) was not closed. Instead, the 1 lot trade (which had been opened at the beginning – screen 1) was reduced from 1 lot to 0.7 (the price shown on the attached image is 1.6908):

Retail Hedge – General information #

Retail Hedge – this concept means that each client’s transaction it is mapped by exactly the same transaction on the hedge account. In this case same number of transactions will always be opened on a hedge account as is open on client accounts. Even when clients have opposing orders open they will be shown on the hedge account 1:1 as on the client’s account.

Important information:

Never close any trades on your hedge account manually, because then your clients will not be able to close their positions!

Retail Hedge rules at liquidity provider #

Through the example it will be easier to understand this rule. The Retail example is best illustrated in practice using a MT5 account connected with a hedge account on liquidity provider.

We assume coverage 100%, which means that if the client opens buy 1 lot of EURUSD in MT5, on hedge it appears with the same volume.

Example 1 #

A BUY trade of 1 lot on EURUSD was opened:

The same position is opened on liquidity provider hedge account:

Example 2 #

A trade in the opposite direction was made, a 1 lot of EURUSD on SELL side:

As mentioned at the beginning of the manual, in the case of opening opposite orders, the same order will be opened on the hedge account.

Example 3 #

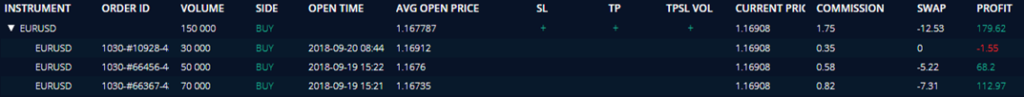

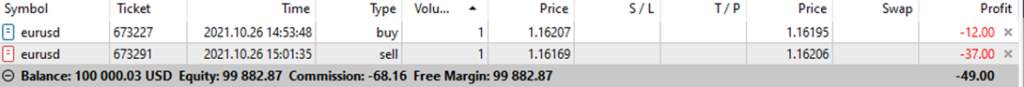

In the next example, we made three trades from a MT5 account – all in the same instrument (EURUSD) and side – BUY. First 1 lot at 15:13, second 0.5 lot at 15:14 and the last 0.3 at 15:16. The value of open positions is over 59 USD loss at the price 1.16167:

At liquidity provider account we could observe the same situation:

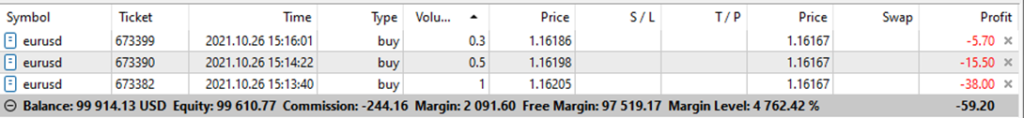

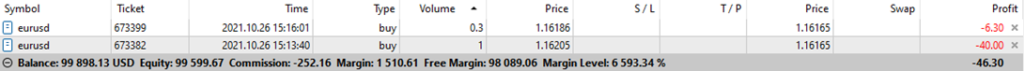

Next, we decided to close in a MT5 account only one, the middle one – 0.5 lot of EURUSD with the loss 15.50 USD (seen in screen 5). So after this action in MT5 account we see two trades (screen 7): 1 lot with loss of 40 USD and 0.3 lot with loss of over 6 USD at the price of 1.16165 :

At the liquidity provider account we could observe that exactly the same trade has been closed.

Short clarification regarding profits on B-Book clients #

When a client is located in a B-Book group it basically means that the risk of clients being profitable is fully on the broker’s side. In such case, all profits/losses of clients have to be covered by the broker. In that case, the broker could use commissions, swaps, and spread markups to decrease the profitability of his clients’ trades. Commission and spread markup are charged for a client during the opening of a trade and are not stored anywhere on a separate account – they simply create a greater initial loss in a client’s trade.

How to calculate profit on hedge account with open positions #

IMPORTANT – Proper profit calculation on a hedge account is possible if the broker did not move clients with open positions between A-Book and B-Book, because these trades will distort final profit.

IMPORTANT – The result can be also incorrect if the broker moved clients between A-Book and B-Book even without open positions. If a broker requests closed trades monthly report from A-Book groups, at a given time (for example at the end of the month) the report won’t include all A-Book accounts and trades from this period as it will only comprise accounts/trades which are A-Book at the moment of report generation.

Profit analysis in a hedge account is fully transparent when calculation is made for the whole history of the hedge account.

Formula for calculating profit:

Hedge Account – MT4/MT5 A-book client’s accounts = Broker Profit

(net open profit + closed profit from hedge account) – (net open profit + swaps + commissions on open position + closed profit from MT4 A-Book)

As mentioned above, the components of the result consist of net profit from the open positions and profit from closed trades. For MT4/MT5 A-Book accounts, it’s net profit on open trades, swaps and commissions from the open positions, and profit from closed trades. With such assumptions, subtracting the result of broker’s retail A-Book clients from the result of the hedge account gives us broker profit.

For example:

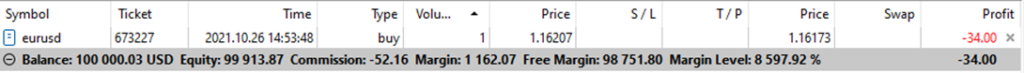

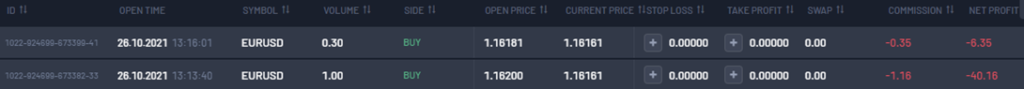

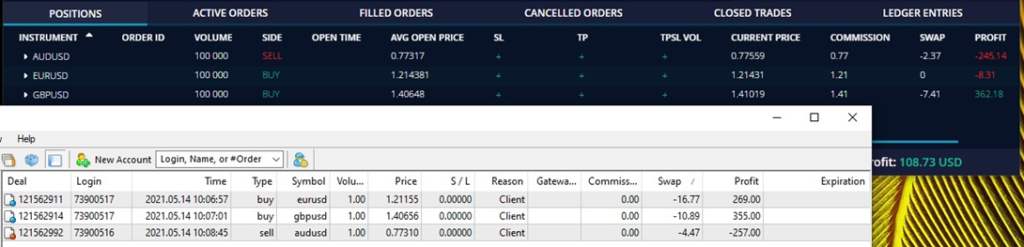

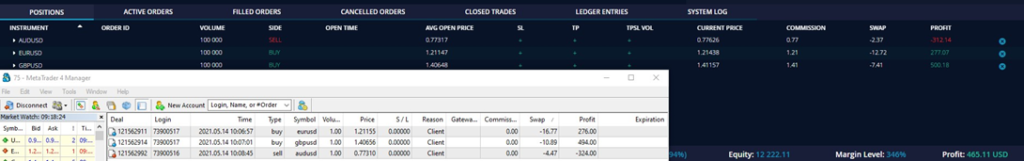

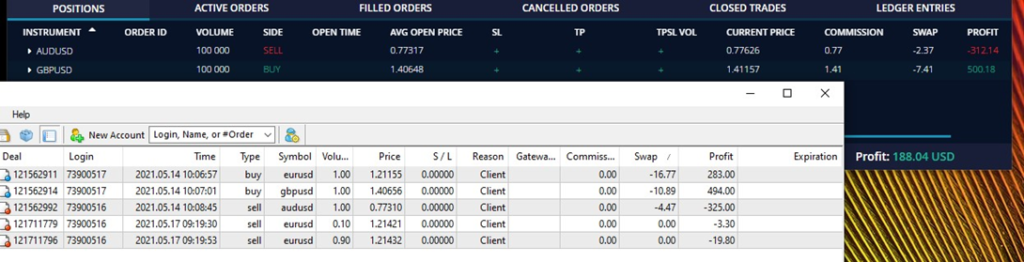

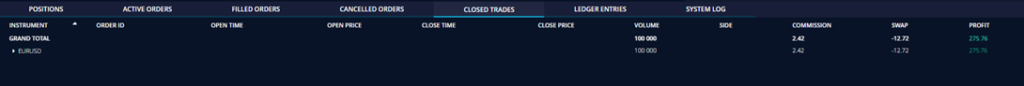

opened positions (hedge account and MT4)

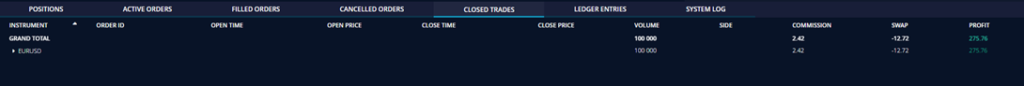

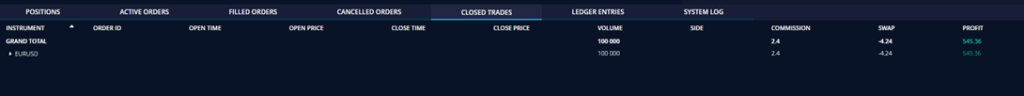

closed positions on Hedge Account

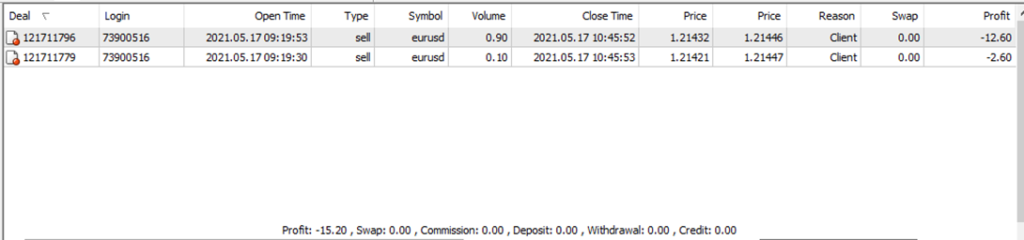

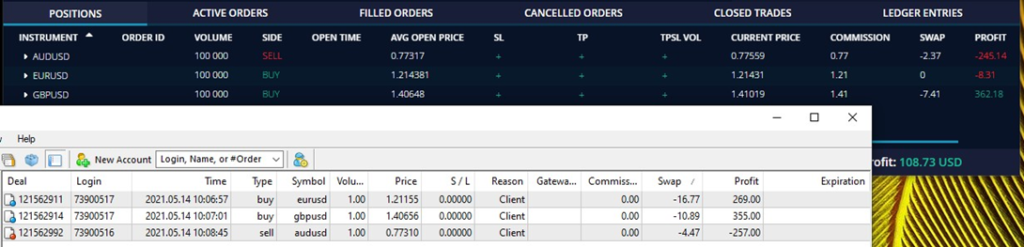

closed positions on MT4 A-Book

Calculation:

Hedge – MT4 = Profit

(108.73 + 275.76) – (367 – 32.13 – 15.20) = 64.82 USD

(opened positions + closed trade from hedge account) – (opened positions + swaps on opened position + closed trades from MT4 A-Book)

When a broker wants to calculate profit for a particular month, he needs to know the exact value of net profit of open and closed trades for the period before the said month – only then such a calculation will give the proper result. If the broker does not have such information, he can use the formula mentioned above to calculate profit from the beginning of trading in the hedge account (assuming that it’s just an A-Book broker or the B-Book clients haven’t been moved to A-Book groups).

Why checking both closed trades and open position profit is crucial to accurately analyse profitability #

Due to FIFO and netting rules, comparing only profit on closed trades (without including open trades) between hedge account and A-Book MT4 will provide incorrectly mapped profit for Broker.

For example:

Broker has two clients on A-Book (73900517 and 73900516) with a sum of balances 10k USD. In the Hedge Account his balance is also 10k USD.

1. 73900517 has opened:

EURUSD BUY 1 lot

GBPUSD SELL 1 lot

73900516 has opened:

AUDUSD SELL 1 lot

2. 73900516 has opened more positions:

EURUSD SELL 0,1 lot and 0,9 lot

Due to the last executed trades by account 73900516 position for EURUSD on the hedge account has been netted and it caused a closure of this position. In the hedge account, there is a trade in the “Closed Trades” tab even though in MT4 no one closed it – it is due to the FIFO/netting rule explained in detail at the beginning of this manual.

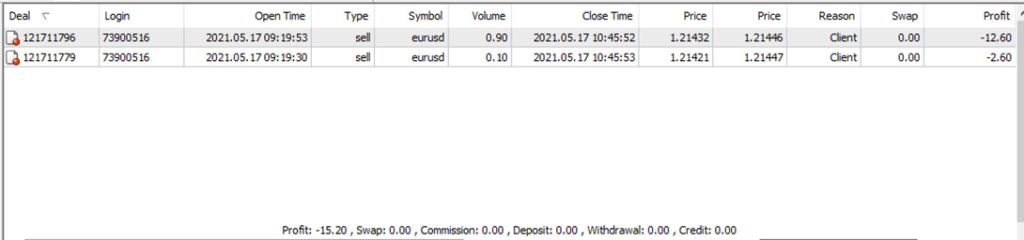

3. 73900516 has decided to close last opened trades:

EURUSD SELL 0,1 lot and 0,9 lot

The client had closed positions on EURUSD and it caused an opening of EURUSD on BUY side in the hedge account.

As we can see, due to the FIFO/netting rule, the value of P/L in the “Closed Trades” tab in both systems is quite different. But if you sum values from closed trades and results from open trades from both systems, then Broker’s profit should match the value of markups/commissions. Therefore, to properly calculate profit, we need to take into account profit from closed and open trades from clients accounts and hedge account.

Where is Broker’s profit from Hedge Account located #

If broker properly sets markups and/or commissions on A-Book clients’ groups, conditions of trading on the hedge account will be significantly better (investors on MT4 will have worse prices/commission for trading). Furthermore, swap points on hedge are smaller than on MT4. If all above conditions are met, then the broker will always receive better results on the hedge account than his clients on their trading accounts.

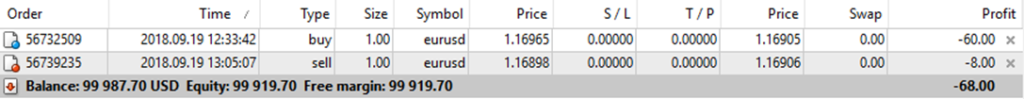

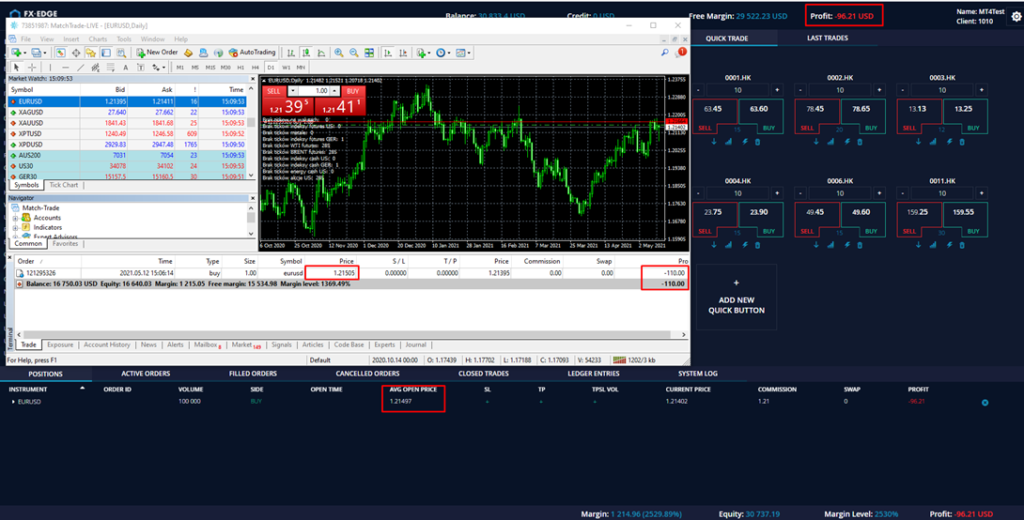

Example:

Broker has added markup in MT4 at 15 points.

As it shows on the screenshot, due to better trading conditions on hedge accounts, loss on hedge is smaller than loss on MT4. It applies to every trade, as long as markups/commissions are set properly (value per 1 lot is bigger than the value of the commission on a hedge account).

According to this rule, Broker’s profit is a difference in balance/equity between the hedge account and all his A-Book accounts in MT4/MT5. So if value is in plus towards the hedge account compared to A-Book clients then we can assume that the broker earns based on his settings (markup/commission). Broker’s profit from A-Book trades is not charged in another specific account or added in another way to an account – it is a difference in valuation of loss or profit between these two systems. For checking whether broker is earning, “Pentaho Reports” (mentioned in this manual) are the best tool for profit measure.

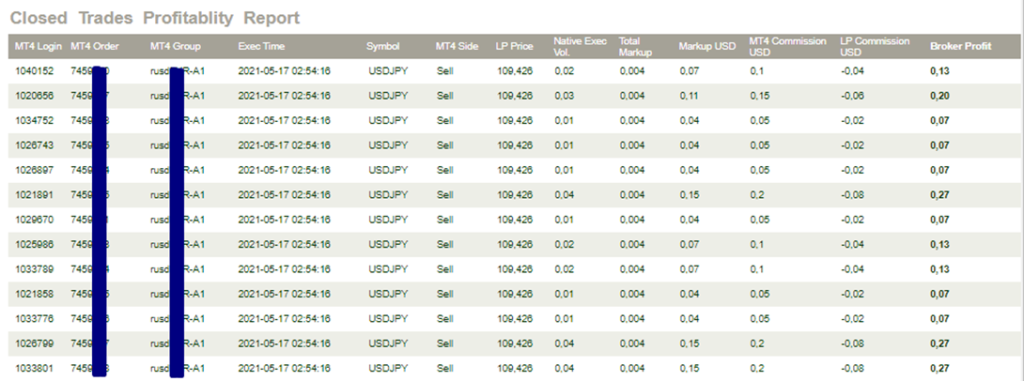

Pentaho reports – checking Broker’s profit on the hedge account #

In order to access the page where brokers can see “Closed Trades Profitability Report” from the hedge account and have a look on their profits on A-Book, broker should login into his Bridge Manager, go to the “Reports” tab, and click on “go to reports page” button which will redirect them to https://reports.match-trade.com/pentaho/Login. Credentials to the pentaho reports page are the same as for the Bridge Manager. In order to check the profit of the broker, one has to go to “Closed Trades Profitability Report” tab. After choosing the dates from which the broker would like to check their profits, a hedge report is generated. Columns are explained one by one in the sequence as they go.

Column explanation

· MT4 Login – Login number of a trading account in MT4/MT5

· MT4 Order – Number of the trade order

· MT4 Group – Group where the trading account is located

· Exec Time – Time at which the trade was executed

· Symbol – Symbol traded

· MT4 Side – Type of the order, sell or buy

· LP Price – Price at which the trade was executed

· Native Exec Vol. – Volume of the trade executed

· Total Markup – Markup given in points

· Markup USD – Markup given in USD

· MT4 Commission USD – Commission that was paid by the client in the MT4/MT5

· LP Commission USD – Commission that was paid by the Broker to the liquidity provider

· Broker Profit – Summarized profit of the Broker of a single trade

The last column “Broker Profit” is crucial for a broker because it is showing what is the total profitability of the hedged trade. If the value is negative, it means that the broker is paying more fees than he is receiving profits per trade from his clients. To change this value he should increase markups in his clients’ group or add commission. To better calculate the exact value which should be added in markups/commission “Markup Calculator” can be helpful for managing values. We’re including such a calculator in the “Starting Pack” but if it’s missing, please contact Support via Skype or e-mail.

Pentaho Reports are the best and easiest way of monitoring and calculating broker’s profit. When a broker moves clients between B-Book and A-Book groups, it creates a discrepancy between the total value from the hedge account and the total value from A-Book clients and the calculations are incomplete.

Besides the “Closed Trades Profitability Report”, it is worth mentioning three other report tabs. First one is “Single Trades Profitability Report”, which calculates profits from trade’s open and close separately. It may be confusing as some of the trades had been opened, but haven’t been closed yet, so it is better to stick with the “Closed Trades Profitability Report” as it is more transparent. Another report worth mentioning is “Detailed Hedging Report”. This report, besides checking profits, enables broker to examine technical data as slippage and execution time. Last report, named “A-Book simulation report” is used for comparison of the actual broker’s profit/loss from clients trading on B-Book and possible gains from those clients if they traded on A-Book. This tool can be useful in spotting profitable clients and reducing potential risks.

Broker Profit discrepancies when moving clients with open positions #

There can be a situation, when a client is moved from B-Book to A-Book with open trades but trades on the hedge account will not be opened at the same entry price as the prices on client trades. Entry price on the hedge account will always be a market price at the time when the client is moved to the A-Book, because the hedge account will automatically adjust positions when the auto-hedge option is enabled. If Broker adjusts positions manually also the price will be the current market price. Due to that, the total profit of clients open positions and total profit of hedge positions will be different because some trades are opened at different price levels. This will also affect Pentaho reports – the outcome of a client that was moved from B-Book to A-Book will not be included in the reports. If trades on the hedge account are opened at market price at the time when the client is moved to A-Book group (not at the price which is present on his clients positions), closed trades between hedge account and A-Book clients will be different.

Moreover, this situation will also affect the MT4/MT5 Closed Trades report. When broker generates Closed Trades report for a given month for A-Book groups and in that month they had moved clients between B-Book and A-Book groups, the report will not fully reflect the real results. This A-Book report will include trades which previously were in A-Book and which had not been hedged. So these actions (moving accounts between groups) can cause discrepancies in reports between hedge account and A-Book clients.

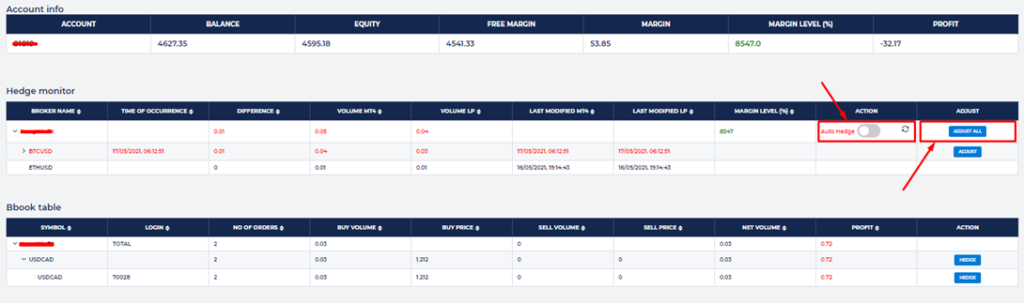

How to control discrepancies between clients positions and hedge account – Hedge Monitor tab in the Bridge Manager #

In order to find out if everything is properly hedged, broker can use the Hedge Monitor which is available in the Bridge Manager. In the tab “Hedge Monitor” broker is able to check what volume is open on the side of his clients and what volume is open on the hedge account.

As it was described in previous chapters, sometimes it can happen that volumes don’t match between these two systems (Hedge Account and A-Book clients’ accounts). The reason for that can be brokers moving clients from A-Book to B-Book group (or vice versa) with open trades. Second case can be a situation when brokers manually open trades in the hedge account which don’t affect the changing volume from the client’s side. There can also be other reasons (stop outs on hedge account, etc), which can cause these discrepancies, so it is very important to monitor this tab on a daily basis.

Hedge monitor will show the exact time the discrepancy happened, the difference between volumes, and after expanding the “broker name”, broker is able to see on which instruments exactly the discrepancy happened. If the reason for the discrepancy is known and the broker wants to adjust it, he can press the button “adjust” which will be visible when the discrepancy occurs. After pressing it, all the discrepancies will be corrected by executing adequate trades on the hedge account.

If such a discrepancy is visible in a hedge monitor and the broker doesn’t know exactly why it happened, Support should be reached to conduct an investigation.

In order to control discrepancies, broker should do daily checks of the hedge monitor. If there are any discrepancies, the broker can adjust it by clicking the Adjust button in the hedge monitor tab.

If a broker is moving clients between groups a lot and they would like to avoid adjusting positions each time manually, it’s better to use Auto Hedge option as this will save time of manual work and financial loss due to unopened positions in hedge account. After enabling this option, every 25 minutes all the discrepancies that occurred between those time intervals are automatically adjusted.